Trump's civil fraud trial gets underway in New York as both sides lay out case

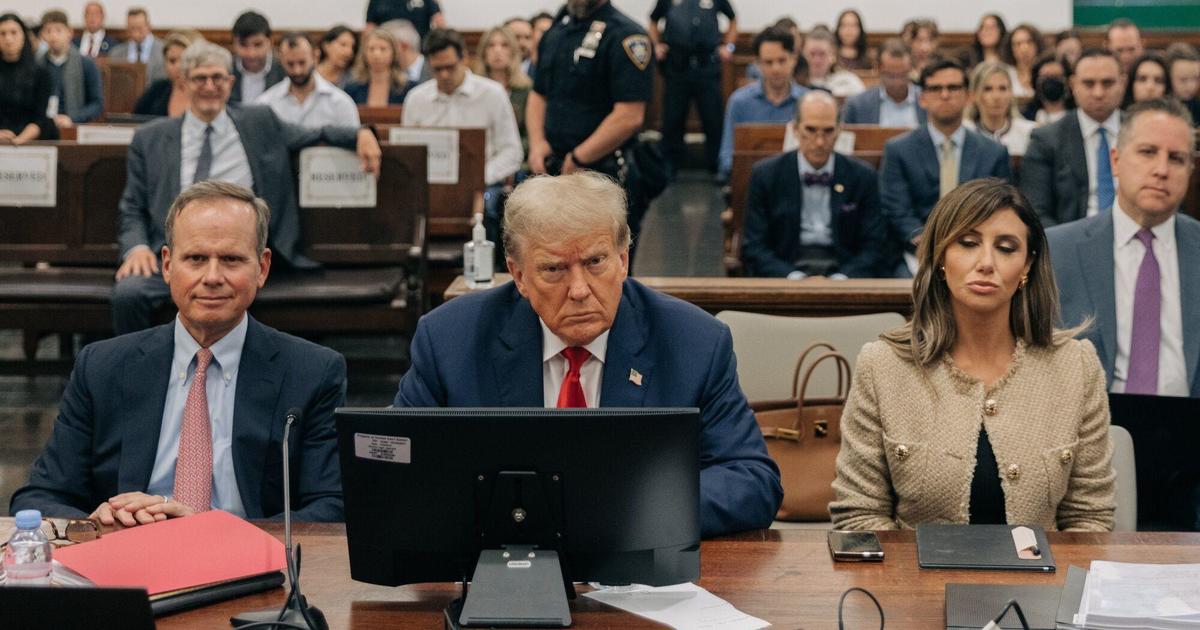

Former President Donald Trump appeared in a Manhattan courtroom on Monday as the trial in his civil fraud case got underway, with attorneys from the New York Attorney General's Office and Trump's legal team presenting their opening arguments before the judge who will decide the case.

Trump, the Trump Organization, several executives and two of his children — Donald Jr. and Eric — are the defendants in the civil trial in New York Superior Court. They're accused of fraud, falsification of business records, issuing false financial statements and conspiracy.

Because it's a civil case, not criminal, none of the defendants will face jail time if convicted. New York Attorney General Letitia James' office is seeking $250 million and a slew of sanctions designed to severely limit the Trumps' ability to do business in New York.

The case will be decided by Judge Arthur Engoron instead of a jury. Last week, Engoron issued a ruling at James' request finding that Trump overvalued his properties by hundreds of millions of dollars — and misrepresented his own worth by billions — while pursuing bank loans. The trial will now focus on other aspects of the lawsuit related to alleged falsification of business records, issuing false financial statements, insurance fraud and conspiracy.

The former president has denied all wrongdoing. Before entering the courtroom on Monday, he said the case was a "witch hunt" and "a disgrace," accusing James of trying "to hurt me in an election."

Trump's civil trial begins with opening statements

The trial, which could last until Dec. 22, got underway in a spacious courtroom in lower Manhattan with a crowd of roughly 130 in attendance. Kevin Wallace, the lead attorney out of more than a dozen on hand from the attorney general's office, delivered the opening statement on behalf of the state. James was seated in the row behind Wallace. Trump was seated at the defense team's table.

Wallace began his 65-slide presentation by noting that they have already shown that Trump's financial statements were false from 2011 to 2021. He said he and his team intended to prove the remaining counts at issue in the case, which include the charges related to allegations of falsifying business records, insurance fraud and issuing false financial statements. He said they would show that the defendants had "the intent to defraud" when falsifying the records and conspired to do so.

"The defendants knew that the statements were false. They then used them to pursue and obtain financial benefits," Wallace said.

Wallace ran through the involvement of key players in the alleged scheme: Trump, his sons, former Trump Organization CFO Alan Weisselberg and Jeffrey McConney, the Trump Organization controller. He said Donald Jr. and Weisselberg were key to the company's valuations for much of the Trump real estate empire. Trump himself certified statements and oversaw the company through 2016, with Donald Jr. and Eric Trump taking over certifying the statements after he won the presidency, according to Wallace. McConney "got into the act" of passing statements to lenders, Wallace said.

Wallace said the defendants denied knowing the preparations were fraudulent during their depositions in the case, showing clips of the Trump sons and the former president himself.

"While the defendants may hope these denials allow them to avoid deniability … were you lying then or are you lying now?" Wallace asked.

Toward the end of his presentation, the lead attorney played a clip from an interview with Michael Cohen, Trump's former "fixer" and Trump Organization lawyer who testified before Congress in 2019 about his former boss' alleged practice of inflating his wealth. In the clip shown in court, Cohen said: "The goal was to use each of the assets and increase its value to reach an end number … to obtain a number that Mr. Trump wanted."

"Mr. Trump would call Allen [Weisselberg] and I into his office. Let's say he was worth $6 billion, but he wanted to be worth more because of the Forbes list," Cohen said, referring to the Forbes list of wealthiest Americans. "So he says, 'Actually, now I'm worth $8 billion.' Mr. Weisselberg and I were tasked with reaching that number."

Since this is a bench trial, Wallace addressed an audience of one, never turning away from Engoron, the judge. Clicking through slides about alleged false claims related to various properties, Wallace said Trump "personally used his statements of financial conditions to secure loans."

He said lying on those statements allowed Trump to secure significantly better interest rates. The total benefit across multiple loans was "well north of $250 million," according to Wallace, the amount the state is asking the judge to demand of Trump.

Trump's team lays out his defense

Chris Kise, the former solicitor general of Florida who is defending Trump and his company in the case, delivered his rebuttal after Wallace's opening statement.

"So you've heard an interesting story from the government. Needless to say, we have a different interpretation," Kise said.

Kise began by renewing his objection to including evidence related to contracts that the defense says are time-barred by statute of limitations. He said the statements of Trump's financial condition that were submitted to the banks "represent a fraction of the overall business empire."

"The statements were true and accurate in all material respects, which, as your honor knows, materiality is" crucial to this, Kise continued.

Trump's statement of financial conditions complied with a different accounting standard governing that specific kind of document, known as ASC 274, Kise argued. He said the standard allows for wide latitude for estimated current values and is "not nefarious."

Kise said the attorney general office's case relies on the testimony of a "serial liar," referring to Cohen.

"He's lied to anyone and everyone he's come into contact with, but the government hinges its case" on him, Kise said.

Much like Wallace, Kise's body and eyes never broke from Engoron.

The defense team will present an expert, a professor at New York University, who will testify that ASC 274 "negates an essential element of the people's case," Kise continued. Another expert will testify that "disagreements" in valuations does not establish fraud was committed, he said.

Kise said that disclaimers on the statements of financial conditions notified banks that the Trump Organization valued properties one way, but banks may value them differently. Kise said banks were in fact required to do their own valuations and analysis. "The evidence will show the level of detail" that went into the underwriting process, he added.

Alina Habba, another attorney for Trump, spoke next following a brief break. She and Engoron have had many heated confrontations over the years in this case.

Habba said the attorney general was "attacking" Trump. She said the valuations of the Trump real estate properties were appropriate and criticized the judge for relying on a tax assessment that valued Mar-a-Lago at $18 million in his ruling before the trial began.

"When you have a home, and you ask for your tax assessment, no one is giving the top dollar," she told the judge. "The value is what someone is willing to pay … That is not fraud. That's real estate."

She said the case is "setting a very dangerous precedent for all business owners in New York."

Clifford Robert, an attorney for Eric and Donald Jr., said James won't be able to show they were engaged in repeated and persistent illegal acts, as required to secure a conviction.

"They relied on the work product of others, which should not surprise anyone," Robert said. "They were not the ones with the green accounting hat on."

for more features.